![]()

Your financial institution requires you to have a certain amount of insurance coverage when you obtain a loan. This service allows you to submit your insurance information online, on your own time, in order to verify that you have sufficient coverage on that loan. We can verify insurance coverage for thousands of people every day through the MyInsuranceInfo website at www.myinsuranceinfo.com.

This service provides members with fast service and an opportunity to communicate with MyInsuranceInfo. Our website is available 24 hours a day, seven days a week, so you can get immediate information. Go to www.myinsuranceinfo.com to access it.

Verify My Insurance

Or

Get Assistance

When you take out a loan, financial institutions require you to have insurance. Using MyInsuranceInfo, you can verify that you have adequate insurance coverage.

The purpose of this article is to explain the MyInsuranceInfo insurance verification process. A simple and secure online process enables you to provide proof of insurance for your loan.

MyInsuranceInfo Insurance Verification Steps

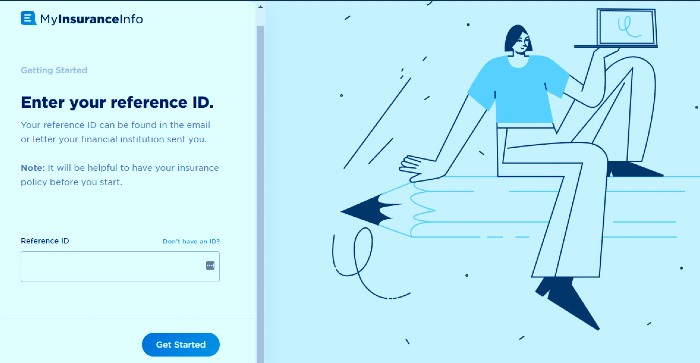

Here is what to expect during the verification process. It is obvious that you need to visit the official portal at www.myinsuranceinfo.com and then follow these steps:

Step 1: Gather your documents

In order to properly verify your insurance coverage, you will need the following documents:

- The notice from your financial institution: On this document (either received in the mail or via email), you will find your unique reference ID. In addition, this document will specify the type of collateral (car, house, boat, RV, etc.) needed for the loan.

- Insurance Policy Documents: They’ll need the name of your insurance carrier, the policy number, the effective date, the deductible amount(s), and the name of the institution that holds the lien on the collateral. Your insurance policy documents will include all of this information on the declarations page.

Step 2: Provide Basic Insurance Information

The MyInsuranceInfo portal will ask you to enter the information from those documents in a guided process that takes about five minutes. It is important to provide your lender with the most current information about your insurance policy.

Step 3: Review and Submit

After reviewing and submitting your information, you have completed your task. You will receive an email confirmation when your information has been correctly submitted, and MyInsuranceInfo will get to work updating your information on your loan.

Within 2-3 business days of submitting your information, you will receive another email letting you know whether everything went smoothly or if any additional steps are necessary.

What Are The Insurance Verification Reasons?

The reason you’re reading this is likely because you received a letter or email from your financial institution asking you to verify your insurance coverage. By partnering with your financial institution, MyInsuranceInfo ensures that your insurance information is accurate and that you are sufficiently covered.

The loan agreement you signed to buy your collateral, such as a home, car, boat, or RV, required proof of insurance to ensure your collateral was protected. Your lender doesn’t know if you have the insurance coverage you agreed to have now for a variety of reasons.

For the record to be set straight, it is a simple fix. You will receive a certificate of coverage from MyInsuranceInfo after completing their easy verification process, and your financial institution will have the most current information about you. The following are some of the reasons you might have received a letter and have to confirm your insurance:

Refinanced Your Existing Loan Or Obtained A New One

Upon taking out a new loan, you will have to provide proof of insurance on the collateral within a certain timeframe. You could receive a notification if your financial institution has not received that insurance information. When you enter your insurance coverage information into the MyInsuranceInfo portal, your financial institution will receive the updated proof of insurance, and you won’t need to take any additional steps.

You Removed Any Of The Required Coverage From Your Policy

Verify your new insurance coverage against the requirements of your loan agreement if you have recently changed your insurance coverage. Some agreements require certain deductible amounts, so if your new policy has a high deductible, you may receive a notice. You can identify any of these discrepancies by examining your loan agreement.

Your Current Insurance Company Canceled Your Policy

It is also possible to receive a notice if you recently canceled an insurance policy. You can submit your new information into the MyInsuranceInfo portal as long as you have sufficient coverage, and we will update our system so your financial institution has your new information.

Your Financial Institution Wasn’t Listed As A Lienholder On Your Insurance Policy

The “lienholder” is the company or institution that loaned you money for this particular purchase, usually a bank or credit union. If your financial institution is not listed as the lienholder, that means that they are not receiving insurance policy updates. Check the declarations page of your insurance policy to find out if your financial institution is listed on the lienholder list. If they are not listed, complete the verification process on this website, then call your insurance carrier to have your lienholder added to your policy.

Expired Insurance

The insurance policy may not automatically renew if your provider is a “non-continuous insurance carrier.”. If you have an insurance policy with a non-continuous insurer, you may have received this notice because your policy has expired.

A Standard Re-audit Of The Insurance Policy

Regardless of whether you have a continuous insurance provider, which means that your policy renews every three years, you will still be asked to confirm your coverage every three years. Therefore, if they have had the same insurance information on file for three years without updating it, they will send you a notice to verify your coverage. You did nothing wrong. The purpose of this step is to ensure you’re still adequately covered. After you complete the simple verification procedure, you should be good to go.

| Official Name | MyInsuranceInfo |

|---|---|

| Managed By | Allied Solutions |

| Country | USA |

| Primary Service | Insurance Verification |

| Requirements | Reference ID |

What Is Collateral Protection Insurance?

Collateral-Placed Insurance (CPI), also known as Collateral Protection Insurance or Force-Placed Insurance, is an insurance coverage used by lenders as a last resort to protect collateral obtained with a loan. The CPI does not provide comprehensive coverage since it only protects what you purchased. The policy does not provide liability coverage, and it does not protect you or others in the event of injury.

CPI is also much more expensive than traditional insurance. Since it covers all of the remaining loan amount, unlike traditional insurance, which covers the collateral’s actual cash value, you’re actually protecting your collateral’s true value.

Your monthly loan payments will increase if you have CPI. You may want to update your insurance coverage information through the MyInsuranceInfo portal if you’ve noticed this sudden rise in your premium.

In addition to the cost increase associated with CPI, this coverage comes with additional risks. If an accident occurs that results in damage or injury, you may still be personally responsible for paying the cost of the damage or any medical expenses associated with the accident.

CPI insures your collateral but not you, so you are at a greater risk. It is, therefore, best to get rid of CPI as soon as possible. In most cases, when people receive a notice asking them to verify their insurance coverage, the issue is resolved without the need for CPI. If you are charged CPI, you’ll want to resolve it quickly. You can avoid paying for CPI by completing MyInsuranceInfo’s secure insurance verification process and ensuring everyone is aware of your insurance coverage.

My Insurance Info Frequently Asked Questions

Where can I find my MyInsuranceInfo reference ID?

If you received a letter in the mail or received an email from your financial institution, you can find your unique reference ID in the upper right-hand corner.

Approximately how long does it take to verify the insurance?

Submitting on the My Insurance Info website www.myinsuranceinfo.com shouldn’t take you more than five minutes. They will send you a confirmation email when they have received your insurance information. The MyInsuranceInfo Insurance Verification Process will be completed within 2-3 business days after that. Your next email will confirm either that no further action is needed or that more information is needed. You will be given further instructions and a phone number to call if more information is required.

What information will I need to verify my insurance?

Although it varies depending on the type of collateral you’re insuring (home vs. car, for example), they usually require you to provide:

- Your unique reference ID

- Name of the insurance company

- The policy number

- The effective date of the policy

- Deductible amount(s)

- Verification that your financial institution is listed as a lienholder

You can find this information on the declarations page of your insurance policy.

What are the documents of a vehicle insurance policy?

The details of your insurance coverage are outlined in your insurance policy documents. These documents contain the coverages, limits, and deductibles of your policy on the declarations page. Your insurance policy also includes your agent’s contact information.

About Allied Solutions

Allied Solutions was formed by the merger of Eldredge Corporation and FLS Services in 2001. They developed a successful business model based on providing customized solutions and exceptional customer service, tailored specifically to each client’s needs so they could do business and manage risks more effectively.

In North America, Allied Solutions provides technology products and services to meet the insurance, credit, and marketing needs of more than 4,000 financial institutions. MyInsuranceInfo is managed by Allied Solutions, which has multiple regional offices and service centers across the country and is a subsidiary of Securian Financial Group, Inc. Allied Solutions is dedicated to helping clients grow, protect and expand their business.

Allied Solutions is a subsidiary of Securian Financial Group, Inc., with 16 regional offices and service centers nationwide. More than 1,300 people work for Allied Solutions. The parent company of Allied Solution is Securian Financial Group, Inc. The company generates an estimated $226.8 million in revenue annually.

A wholly-owned and independently operated subsidiary of Securian Financial Group, they provide solutions to over 4,000 clients in North America. Because of their independence and the depth of our client base, they can offer the most innovative and competitive products and services on the market today.

Closing Remarks

The purpose of MyInsuranceInfo is to ensure that you have enough insurance coverage for your home, vehicle, RV, or any other valuable asset. With their platform, you can submit your information without wasting precious time waiting to speak to someone, and at your own convenience. It takes less than five minutes to verify your insurance coverage and ensure that your financial institution has your up-to-date information.

Your financial institution may have notified you that you need to update your information. Each month, MyInsuranceInfo verifies thousands of individuals. You might have received a notice for one of the reasons listed above. You can resolve this misunderstanding by completing the short verification process through the MyInsuranceInfo portal.